We are delighted to celebrate the fifth-year anniversary of the Sanlam Credit Fund, launched on the 31st August 2016, managed by Peter Doherty, Guillaume Desqueyroux and Darren Reece.

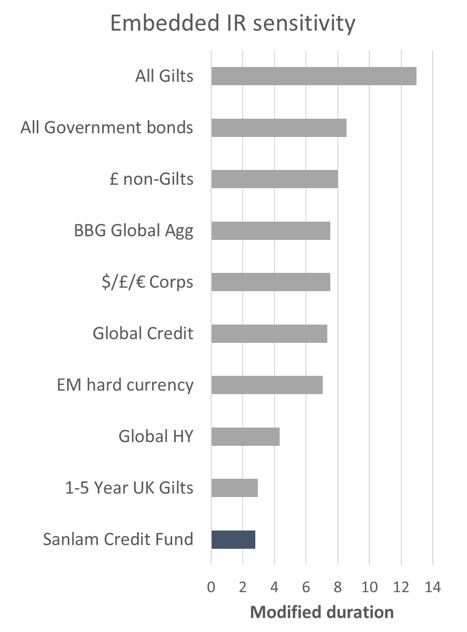

A high conviction global corporate bond fund with a unique blend of low volatility, low duration but high returns designed for investors seeking shelter outside of more volatile asset classes.

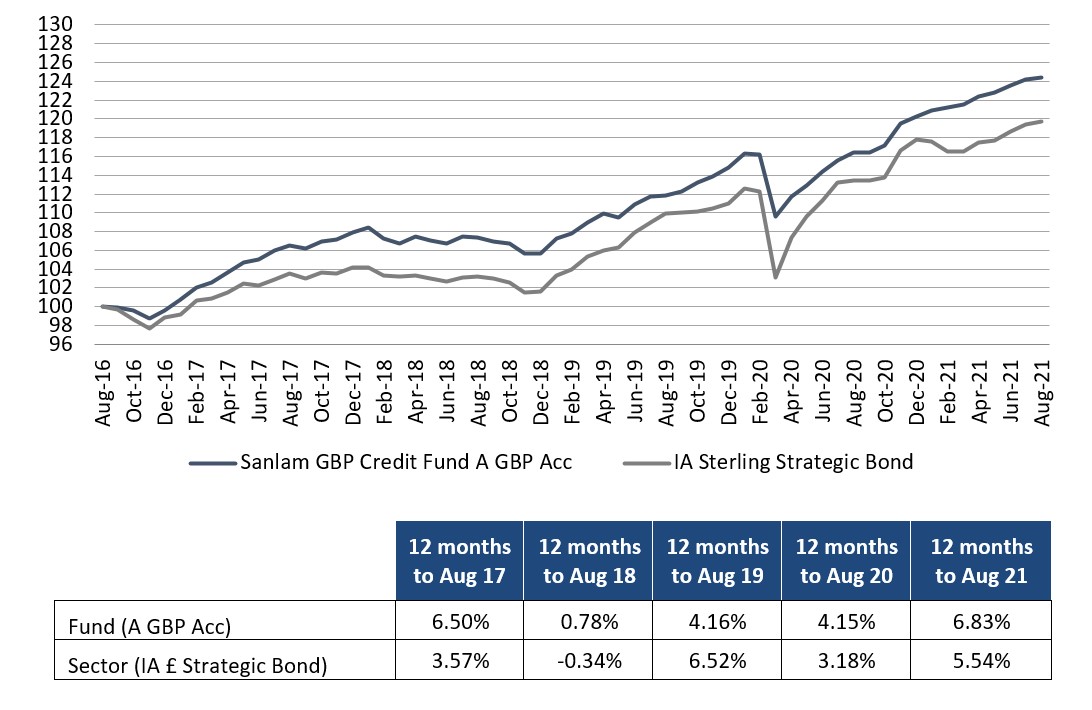

The fund has delivered total return of 24.4% over 5 years

The team takes much comfort in achieving returns well ahead of government curves and beating inflation by some margin.

Past performance is not a guide to future performance.

Performance data shown is that of the Sanlam Credit Fund, Class A GBP Acc. Performance is shown on a bid price basis, with net income reinvested, net of fees. Source: Morningstar and Link as at 31/08/2021

A challenging period for bonds

Investors should have no hesitation in recognising some of the market moving events that have taken place over the past 5 years, including the Brexit saga, a stop-start Central Bank interventionism, President Trump and the US-China trade conflict, as well as an historically low interest rate environment and not least a global pandemic.

We are therefore immensely proud to report that the Sanlam Credit Fund is a top quartile performing fund within the Investment Association Sterling Strategic Bond, delivering 4.5% annualised. It’s very short duration (below 3) in the category and its long-only investment strategy are key factors in its achievement of a 4-star Morningstar rating*. Note, this is the fund’s 3-year rating, 5-year rating is not yet available from Morningstar. Past performance is not a guide to future performance.

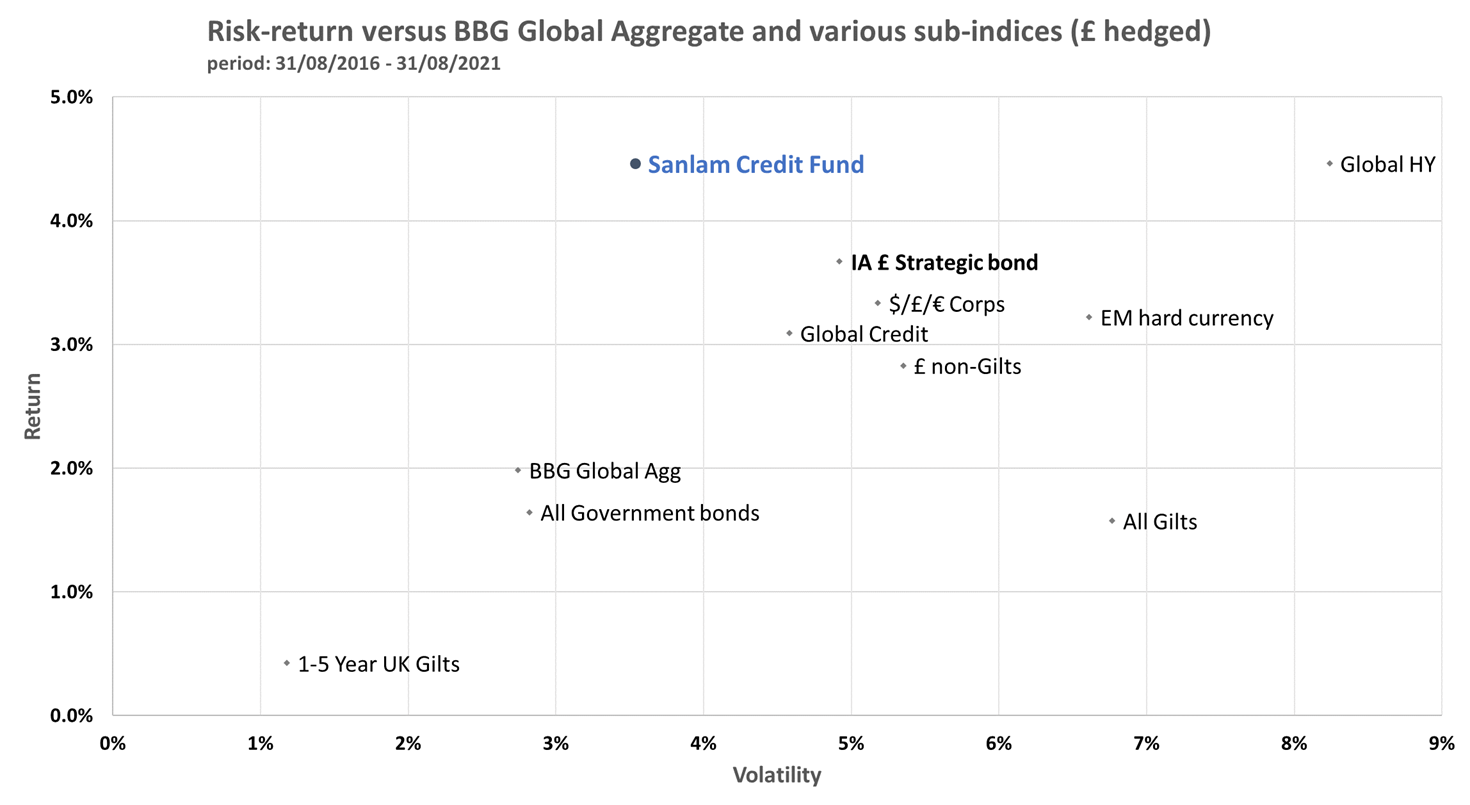

Higher performance, meaningfully less relative risk

The fund seeks capital preservation and downside protection with an all-important short duration strategy and typical low to medium risk profile. The downside protection priority is reflected in an excellent Sharpe ratio, of 1.1 since inception**, where every unit of risk must be compensated by a satisfactory return. It is illustrated in the fund’s performance versus major fixed income asset classes, while carrying meaningfully less interest and credit risk (Global High Yield, Emerging Market hard currency).

Past performance is not a guide to future performance.

[1]

Sustained returns. Sustainable credentials

The stable investment team has strengthened its line-up adding a highly experienced corporate sector fund manager, and a macro/inflation specialist. Furthermore, the fund manager, Peter Doherty, received an FE Fundinfo Alpha Manager award this year. Past performance is not a guide to future performance.

Over the past 18 months the Sanlam Group has helped the team to improve its trading capabilities/reach and embedded ESG factors into the investment process with the fund obtaining an ‘A’ MSCI ESG Quality score.

Carefully executed strategy

The fund is constructed around four main themes to achieve a risk-controlled bond portfolio while identifying inefficiencies in the fixed income market. Importantly, these themes are both repeatable and highly scalable.

-

The Predictable income component allows the Investment Team to identify companies and securities that display more certainty on future cash flows.

-

New Issues enable the Team to proactively engage with issuers and syndicate managers, identifying financing opportunities, arbitrage and pricing.

-

Unrated bonds (and in many cases under-researched) are an important differentiator as the Team can conduct in-depth analysis and identify securities overlooked by many of our competitors.

-

The Change in capital treatment captures the team’s expertise in understanding the evolving regulatory frameworks for the Financial sector.

The Investment Team believe that the corporate bond market is inherently inefficient and the fund benefits significantly not through outsized concentration bets or indeed the reach for duration, but when it takes advantage of valuations that are out of line with true fundamental fair value. These inefficiencies and anomalies allow the fund to generate potential returns well above those on offer in the generic market when compared to other short duration funds without exposing investors to additional risk.

Why Sanlam Credit Fund?

With the first five years now firmly behind the team, and a demonstrable track record of having generated strong returns in the form of a steady income stream and substantial capital appreciation, the fund is now well positioned to meet the varying needs of investors with a high degree of credibility, reliability and substance.

Further information on the fund is available here or get in touch with our sales team.

[1] Source: Bloomberg, except for Morningstar for the £ IA Strategic Bond, Sanlam Credit Fund’s sector, as at 31/8/2021. Morningstar does not share any Modified duration for the IA Sector. Graph above depicts data of the Sanlam Credit Fund, its sector and various Bloomberg Fixed Income indices and sub-indices. Details concerning relevance of the various indices: Global Credit, Global High Yield, $/£/€ Corporates and £ non-Gilts: underlying assets have a similar scope to the investment universe of the Sanlam Credit Fund; All Government bonds, 1-5 Year UK Gilts and All Gilts: underlying assets represent the lowest-risk (or traditionally ‘risk free’) end of the Fixed Income market and therefore can be used as a baseline of comparison; Emerging Markets hard currency: underlying assets are not represented in the Sanlam Credit Fund as the fund is not active in emerging markets, however, this is graphed for representational purposes of what is achievable away from this product; BBG Global Aggregate: underlying assets represent the exhaustive debt investment universe.

* A GBP Acc and B GBP Inc Share Classes

** Sharpe ratio formula Sharpe Ratio = (Portfolio Return – Risk-free rate of return ) / Standard deviation of portfolio return

Disclaimers

Marketing material for professional investors only. Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

Fund risks:

The fund will invest in debt securities. The government or company issuer of a bond might not be able to repay either the interest or the original loan amount and therefore default on the debt. This would affect the credit rating of the bond and, in turn, the value of the fund. Investment in bonds and other debt instruments (including related derivatives) is subject to interest rate risk. If long-term interest rates rise, the value of your shares is likely to fall. The Fund may engage in transactions in financial derivative instruments for hedging purposes only. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions.